Managing money has never been easier thanks to technology. Whether you’re budgeting for daily expenses, saving for your jackpot dream vacation, or tracking investments, there are powerful finance apps in Canada designed to help you stay on top of your financial goals.

Apps for Managing Finances

Here’s a look at the best apps for managing finances in Canada, from budgeting and saving to investing and credit tracking.

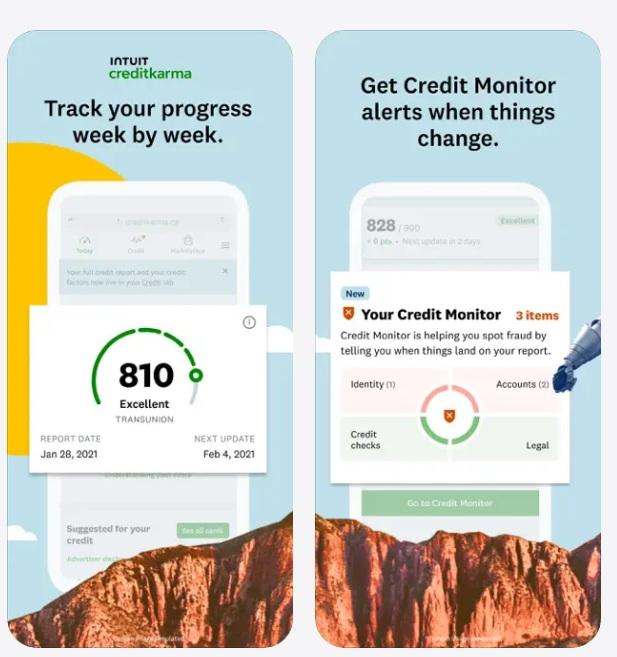

1. Credit Karma

Credit Karma

Best for: All-in-one budgeting and expense tracking

Platform: iOS, Android

Previously known as Mint, Credit Karma by Intuit is one of the most popular personal finance apps in Canada. It automatically tracks your income, spending, and bills by syncing with your bank accounts.

What will you find

-

Real-time expense categorisation

-

Budget goals and bill reminders

-

Credit score tracking

-

Free to use

Why Canadians love it: It gives a complete picture of your finances in one clean dashboard and is great for beginners and busy professionals.

Download for Android | Download for iOS

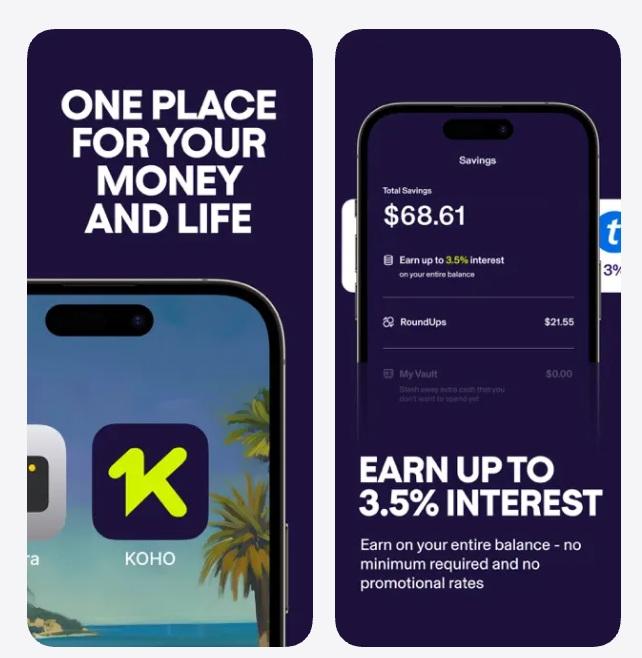

2. KOHO

Koho App

Best for: Budgeting and saving with a prepaid card

Platform: iOS, Android

KOHO is a Canadian fintech app offering a reloadable prepaid Visa card that helps you spend smarter. It tracks every purchase, rewards you with cashback, and lets you save automatically.

What you will find

-

Instant cashback on every purchase

-

Real-time spending updates

-

Automatic savings goals

-

Credit-building option available

Why it’s great: Perfect for anyone who wants to control spending while earning rewards, no credit checks or hidden fees.

Download for Android | Download for iOS

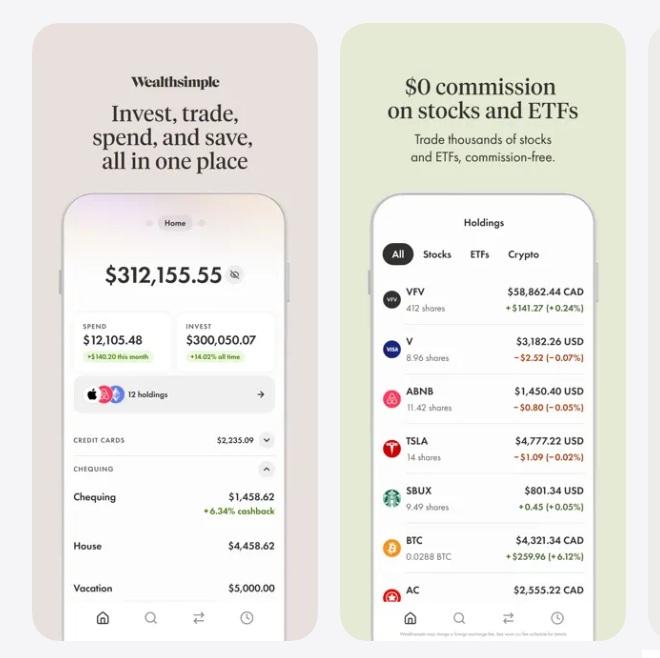

3. Wealthsimple

Wealthsimple App

Best for: Investing and wealth management

Platform: iOS, Android, Web

Wealthsimple is one of the other apps for managing finances and is one of Canada’s top investment and money management platforms. It helps users invest in stocks, ETFs, and even crypto with zero account minimums.

What will you find

-

Automated investing portfolios

-

Commission-free trading

-

Crypto trading options

-

Financial advice and tax tools

Why Canadians love it: Simple, transparent, and tailored for both beginners and experienced investors.

Download for Android | Download for iOS

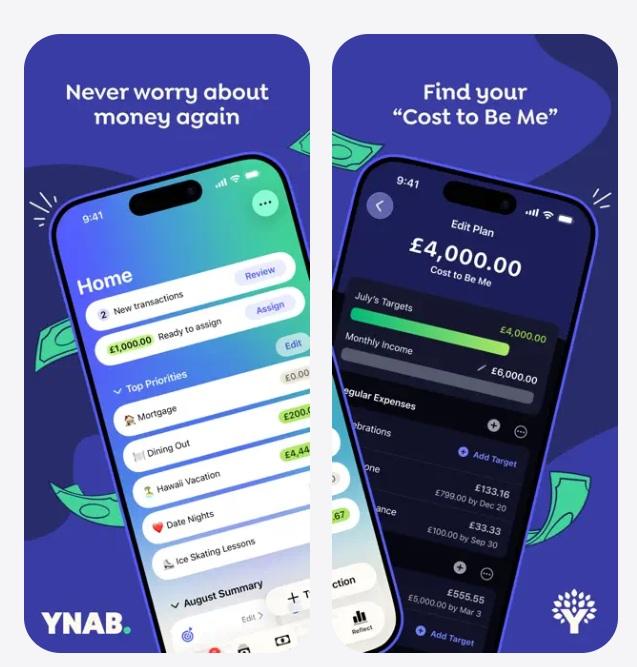

4. YNAB

YNAB App

Best for: Hands-on budgeting and debt control

Platform: iOS, Android

YNAB, or you need a Budget app, helps Canadians plan every dollar and break free from paycheck-to-paycheck stress. It encourages proactive budgeting and goal-setting.

What you will find

-

Goal-based budgeting system

-

Debt payoff tracking

-

Cloud sync across devices

-

Detailed spending reports

Why it’s great: YNAB is ideal for people serious about building financial discipline and saving for long-term goals.

Download for Android | Download for iOS

5. Moka

Moka App

Best for: Saving and investing spare change

Platform: iOS, Android

Moka, previously known as Mylo, rounds up your everyday purchases to the nearest dollar and invests the spare change automatically. It’s a smart, effortless way to start investing.

What you will find

-

Automatic round-up investing

-

Custom goals and savings plans

-

Registered accounts (TFSA, RRSP)

-

Low monthly fee

Why Canadians love it: It helps users grow wealth passively, without needing to be a finance expert.

Download for Android | Download for iOS

6. GoodBudget

GoodBudget

Best for: Budget Tracker and Planner

Platform: iOS, Android

Goodbudget is a money manager and expense tracker that’s great for home budget planning. This personal finance manager is a virtual update on your grandma’s envelope system.

What will you find

- Proactive budget planner that helps you stay on top of your bills and finances.

- Easy, real-time tracking.

- Sync and share across your Android, iPhone and the web.

Why Canadians love it: This virtual budget program keeps you on track with family and friends with the time-tested envelope budgeting method.

Download for Android | Download for iOS

How to Use Apps for Managing Finances Effectively

To use apps for managing finances in Canada effectively, follow the tips below:

-

Sync only with trusted apps that use bank-level encryption.

-

Set clear goals (savings, debt payoff, investments).

-

Check reports weekly to monitor progress.

-

Combine apps smartly: For example, Credit Karma is for budgeting, + Wealthsimple for investing.

Final Thoughts

The best apps for managing finances in Canada empower you to take control of your money, track spending, and make smarter decisions every day. Whether you want to save, invest, or simply stay organised, apps like KOHO and Wealthsimple can make financial management easy and stress-free, right from your phone.